Mascot Towers is a strata disaster. Locked out of their homes and business premises for almost 5 years, the owners of Mascot Towers are ‘desperate and exhausted’.

The owners have tried everything.

- They sued the builder and the developer, and their neighbour for compensation for building damage, with mixed success.

- They raised a loan to repair the building, but decided it was better to try to sell the building ‘as is’. A developer offered to buy the building, but the price was low and not all owners agreed to sell.

- They asked the court to terminate the strata scheme so as to sell it as a “knockdown”, but the Supreme Court of New South Wales refused to terminate the strata scheme because building remediation was viable.

This is an analysis of the judgment of the Supreme Court of New South Wales: The Owners – Strata Plan No 80877 v Lannock Capital 2 Pty Ltd [2023] NSWSC 1401 (Peden J) (24 November 2023).

Background facts

The facts draw upon the judgment and the public record.

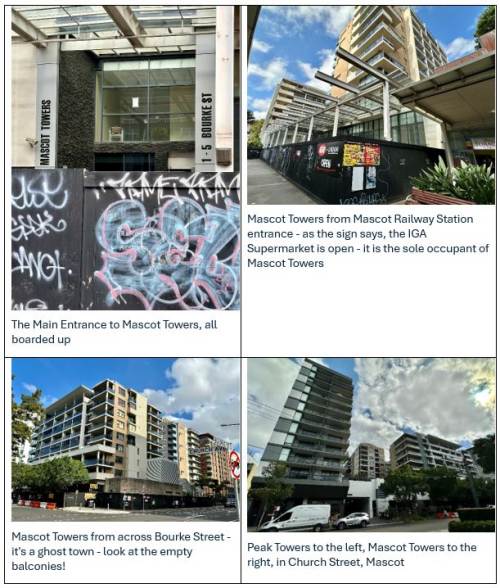

The Mascot Towers strata consists of two towers of 10 storey high rise with residential and commercial strata units located at 1-5 Bourke Street, Mascot in Sydney, New South Wales.

The strata plan was registered on 30 July 2008. The strata scheme is large – there are 141 lots. Currently, there are 132 owners.

Between 2011 and 2018, building defects from the construction were found and rectified. The Owners Corporation (‘OC’) brought legal proceedings against the builder/developer and building manager for the rectification cost. The proceedings were settled.

On or around 18 April 2019, significant structural defects were first identified in the transfer beams in the basement of the building during a routine inspection. On the evening of 14 June 2019, Fire and Rescue NSW issued an evacuation order because the building was deemed to be unsafe and at risk of collapse. That order was confirmed on 21 August 2019, on engineer’s advice that the building was unsafe, and occupants’ safety could not be guaranteed.

The NSW State Government provided a generous rental assistance package for owner occupiers and tenants until 30 June 2023. Investors were not eligible. Strata levies, Council and Water Rates and mortgage repayments remained payable.

Strata Insurance covers accidental damage to buildings, theft and legal liabilities. Earth Movement (including subsidence, settlement or shrinkage of earth) are policy exclusions. There was therefore no building damage or rent loss cover.

On 22 August 2019, at an extraordinary general meeting, the owners resolved to carry out the first stage of some remedial works and to raise a Special Capital Works Fund Levy of $7 million payable by nine instalments, which equated to $5,000 per month for a one-bedroom unit and $10,000 per month for a three-bedroom unit. Some owners started paying the Special Levy, others did not.

On 22 October 2019, at an extraordinary general meeting, the owners rescinded the Special Levy, and resolved to enter into a $10 million “multi-drawdown” finance facility with Lannock Capital 2, a strata financier, to be drawn down to fund the rectification works (‘First Lannock Facility’).

On 21 May 2020, at an extraordinary general meeting, the owners resolved to commence legal proceedings against the builder, developer and engineer of the adjacent Peak Towers building. The owners corporation claimed that the structural defects discovered in April 2019 were caused by deep excavation of the basement carpark which was underway on the Peak Towers site. They claimed damages of $21.5 million for repairs from the developer and the structural engineer of Peak Towers.

The claim did not go to hearing. In or around May 2023, after expending $3 million in legal fees, including significant fees for geotechnical and other expert evidence, the OC was paid a confidential settlement sum.

Comment: Does the settlement indicate that the Mascot Towers building had pre-existing severe structural damage, as the developer alleged, or had the structural engineer’s liability insurance had reached its limit? We’ll never know. The settlement sum was less than the amount required to repair Mascot Towers.

By October, 2020, the First Lannock Facility had been exhausted due to the cost of engaging experts and builders, and legal fees in the Peak Towers proceedings. More funds were needed to cover the (then) cost estimate of $33.8 million for rectification. On 19 November 2020, at an extraordinary general meeting, the owners resolved to enter into the Second Lannock Facility, for $22.5 million (at an interest rate of 12.5% pa).

Also at the meeting on 21 May 2020, the owners resolved to explore a collective sale of the home units and commercial units (the ‘lots’) in the building pursuant to the new Part 10 of the Strata Schemes Development Act 2015 (NSW). They put remediation on hold.

The highest offer received was $42 million from a developer, in April 2021. The offer was conditional upon unanimous approval from the owners.

Comment: If all of the 141 lots were the same, the offer would equate to $297,000 per lot.

On 3 June 2021, at an extraordinary general meeting, a majority of the owners resolved to accept the developer’s offer (69 for, 12 against). While that majority vote satisfied the 75% majority required for a collective sale under Part 10, the developer’s offer was conditional upon 100% of the owners agreeing to sell. The sale process failed because not all owners agreed to sell. The OC needed to find another solution.

On 4 April 2022, at an extraordinary general meeting, the owners resolved to proceed to apply for an order of the Supreme Court to terminate the strata scheme pursuant to Part 9 of the Strata Schemes Development Act 2015 (NSW) and for directions for the winding up of the scheme (71 for, 10 against, 1 abstention, 9 invalid – non-financial). The ‘advantage’ of the Part 9 termination procedure over the Part 10 collective sale procedure was that a Court ordered termination can override owners who are against selling.

On 30 May 2022, the Application was made to the Supreme Court for termination under Part 9.

As at 30 May 2022, the sum outstanding under the First Lannock Facility was $9,420,977.49 and the sum outstanding under the Second Lannock Facility was $6,282,742.04. The loan repayments were up to date and remain up to date.

The Application was opposed by Lannock Capital because repayment of its loan facility would be prejudiced by a termination order. It submitted evidence that it was viable for the building to be remediated. The banking institutions who held registered mortgages over approximately 110 units were not opposed but required their loans to be repaid in priority to Lannock Capital, if the strata scheme were terminated.

The decision

Termination orders for a strata scheme are rare. In reviewing the small number of decisions where orders had been made since 1961 (the year Strata Law began), Justice Peden summarised the common features:

“In all cases, the Court was dealing with an owners corporation, which did not appear to have significant liabilities, where the strata scheme was relatively small and the application was brought with unanimous consent, including where there was only one owner of all lots.” [at paragraph 31 of the judgment]

“Uniformly, the Court’s concern has been to ensure existing rights in relation to the scheme’s assets, primarily land, are replaced with like rights after a termination.” [at 32]

A recent decision where a termination order was made was Brenchley v The Owners – Strata Plan No 80609 [2022] NSWSC 646 (Brenchley), a decision of Robb J (Supreme Court of New South Wales). The strata scheme consisted of 5 lots.

The Court quoted the reasons Justice Robb gave for making the order:

“The plaintiffs owned 3 of the lots and 2 were held by the second defendant. The building had become uninhabitable, such that the termination of the strata scheme was “inevitable”. There was evidence that there would be a higher return to lot owners if the entire building was demolished and redeveloped. … all parties considered termination was appropriate and were only divided on the appropriate directions for the winding up of the scheme.” [at 58]

The difficult part was the directions to be made. The Court, quoting Justice Robb, said:

“there is no established regulatory scheme for the determination of the assets and liabilities of the strata scheme and the determination of claims by and between lot owners and the owners corporation.” [at 58]

“The orders Robb J made protected the registered mortgagee’s interests.” [at 59]

The Justice Peden said that there were significant differences in the Mascot Towers case:

“Mascot Towers is a large strata complex, not all of the lot owners consent to the termination of the scheme, and there are several debts owed by lot owners and the owners corporation, such that a termination order will affect the interests of several creditors. Further, there is no clear evidence that the building must be sold as a “knockdown”, nor that it is commercially unwise to carry out repairs.” [at 60]

The considerations were:

- Is the Owners Corporation insolvent?

“There is no evidence that the OC is not able to pay its debts as required.” [at 66] - Have the Owners been sufficiently informed?

“The Court has concerns about the understandings and intentions of all of the lot owners and the availability of protections for them and creditors in a Part 10 process” (Part 10 of the Strata Schemes Development Act 2015 (NSW) – ‘SSDA’) [at 67], and gave these reasons:

“This is not a straightforward case where termination of the scheme and demolition of the building is inevitable.” [at 67]

“The OC’s evidence is unclear as to exactly what information was before the 2022 meeting concerning the Part 9 and Part 10 processes, including information about the likely cost and timing of rectification works.” [at 68]

“the parties’ experts now agree that further rectification costs would be at most $21.5 million. Further, the experts agree that lot owners could re-occupy within 6 months, with complete rectification being achievable within 12 months.” [at 69]

“A particular concern for the Court is whether lot owners understand the extent of their personal liability for the OC’s debts.” [at 69]

‘In all cases where a termination of a strata scheme has been ordered, it has been done cautiously, and only where every lot owner within the scheme seeks such an order. That is not the case here.” [at 71]

“Currently, it is not apparent whether all the lot owners understand that their potential liability for the OC’s debts could extend beyond their proportionate interest in the pooled fund that would be achieved in a sale of the building; in fact, lot owners would have to contribute in proportion with their unit entitlements to the OC’s debts, even if they received insufficient funds from the sale process …” [at 80]

“An owners corporation is able to commit itself to an unlimited sum and thereafter levy lot owners for contributions to meet its expenses until sufficient funds are raised. To that extent only, it might be said that lot owners have “unlimited liability”.” [at 117] - Is a Part 10 collective sale a more appropriate process?

“Part 10 of the SSDA provides a mechanism for a 75% majority of owners to nevertheless apply for a Court order approving the collective sale of the all the lots. Reluctant owners can be compelled to join in a collective sale, but only after various detailed procedures found within ss 170-190 SSDA have been satisfied, and the Land and Environment Court approves a specific sale (see s 182 SSDA). Such a process provides all lot owners with certainty about a sale price and process, with a clear and known outcome for each of them.” [at 72]

The OC argued against Part 10:

“…[the] collective sale process is cumbersome, lengthy and expensive and there is no assurance it would result in a better outcome.” [at 73]

But the Court was not convinced for 2 reasons:

“First, ... it has not been demonstrated that the Part 10 process would achieve a lower price than a “liquidation sale.” [under Part 9] … [the] evidence is that the current value of the building as-is is $59.75 million, and, if rectified, would be $122.3 million. That evidence taken together with the joint expert opinion, suggests that if the further approximately $20 million was spent on rectification works, then there is a value in the building of about $100 million (not taking into account other assets or liabilities of the OC). Therefore ... the OC could obtain a better price than that offered by a potential buyer of the whole building in 2021, irrespective of the sale process.” [at 76, 77]

“Secondly, Part 10 provides protections for lot owners and creditors. The authorities show that if making a termination order, the Court is anxious to protect all those with an interest in the lots in the strata scheme. However, there is no legislative provision, nor authority, that explains how those interests ought to be protected when there is competition between them, because there is a risk that there will be insufficient funds to satisfy those interests. Those issues would necessarily be considered and resolved in a Part 10 process, and all lot owners would be given full details of the consequences and have an opportunity to voice their concerns to the Court, pursuant to s 180 SSDA, without becoming a party to the proceedings and incurring costs consequences.” [at 78] - Why didn’t the Court order remediation?

Her Honour Justice Peden decided that the Court could not order the OC to carry out the remediation for these reasons:

“I do not accept that the Court can recommend, or mandate, that the lot owners decide to repair the building using the Lannock funds, in the hope of obtaining a better financial outcome, rather than the sale of the unrepaired building.” [at 85]

“Further, it is unlikely that a lot owner would claim that the OC is in breach of its s 106 SSMA obligation to “repair and maintain” the building, in circumstances where the extraordinary general meeting voted to seek a termination order and to date no lot owner has agitated for that.” [at 86]

Conclusion

The Court “was not prepared to terminate the scheme as an alternative to a failed collective sale process, where it was not necessary to demolish the building.” [at 84]

Do the registered mortgagee’s interests have priority for payment?

The Court considered this as a hypothetical issue, given no termination order was to be made. The question is: Is Lannock as lender to the owners corporation, to be paid from any pooled sale fund in priority to the registered mortgagees of the individual lots or do the registered mortgagees have priority to receive proceeds of sale?

The Court concluded that the registered mortgagees have priority:

“they must be given a charge over that portion of the fund that represents the mortgagor/lot owner’s interest in that fund” [the proceeds of sale]. [at 105]

Where does that leave Lannock? Lannock is an unsecured creditor of the OC (lenders to OCs are prohibited by the Strata Schemes Management Act 2015 (NSW) (‘SSMA’) from taking security).

The Court said that on sale, each lot owner would be liable to contribute to the debts of the OC, similar to the way strata levies are raised, in their unit entitlement proportion. Lannock must look to repayment of its loan from strata funds.

Why the Strata Law has failed the owners of Mascot Towers

The Strata Law gives owners a number of options when dealing with a building which has become uninhabitable because of damage.

The Mascot Towers owners tried these options, unsuccessfully:

- Raising a Special Levy to fund the repairs. Many owners failed to pay, and the Special Levy was abandoned. The administrative fund and capital works fund levies have continued to be payable despite the owners being unable to occupy their property.

- Raising a loan from a Strata Lender to fund repairs and for legal fees. The loan was raised. It is not apparent why the repairs were not carried out with these funds, except that a Collective Sale or Termination must have seemed to be a better option.

- Collective Sale. This was attempted, but the offers made by property developers were at knock-down prices, insufficient in the case of many owners to clear their debts. A minority opposed the sale.

- Termination. This rarely used procedure was a long shot. The Court ruled it out as not appropriate, because remediation was commercially viable.

Comment: Can you see what’s missing?

The right to require the OC to repair exists. Section 106(1) of the SSMA imposes a duty on the OC to properly maintain and keep the common property in a state of good and serviceable repair.

But there is no quick and effective procedure to enable owners to apply to the Court for the property to be repaired. The procedure is potentially lengthy and expensive and risks a liability for legal costs. In this case, the Court decided it could not make such an order against the OC, even if it had been requested.

The State Government has already provided financial assistance in the form of rental assistance to all the owners of Mascot Towers.

The State Government should now appoint a special purpose administrator to take control of the OC and to carry out the remediation (this is the owners request).

There is a precedent in terms of the appointment of an administrator in the Part 9 procedure. Where the Court makes a termination order under Part 9, it orders an administrator be appointed to wind up the owners corporation.

The special purpose administrator must have the power to appoint a project manager and builder to carry out the repairs, so as to be able to hand back a refurbished property to the owners. And the power to use the loan facilities and raise ordinary and special levies to fund the repairs. Registered liquidators perform this role day in day out, when appointed to companies which have half-built buildings.

This right should be made part of Strata Law.